Ask Congress to pass the Neighborhood Homes Investment Act today!

Neighborhood Homes is a bipartisan solution to expand homeownership supply and revitalize neighborhoods and small towns throughout the country

The U.S. is facing a severe shortage of over 7 million single-family homes, driving up housing costs and locking out first-time homebuyers. The Neighborhood Homes Investment Act would create a federal tax credit to build and rehabilitate affordable homes for urban, suburban, rural, and tribal communities, giving families opportunities to build wealth where they live and work.

About Neighborhood Homes

Advocacy

Join us in advocating for the Neighborhood Homes Investment Act!

Check out our resource library where you will find fact sheets, bill summaries, and talking points to assist you in your meetings with elected officials.

Bipartisanship

The Neighborhood Homes Investment Act is widely supported in Congress, having been introduced by Representative Mike Kelly (R-PA-16) and Representative John Larson (D-CT-1) in the House and Senator Todd Young (R-IN) and Senator Mark Warner (D-VA) in the Senate.

The bill gained strong backing in the 118th Congress, with 111 House cosponsors, including 17 members of the House Ways & Means Committee.

Click here to see if your members of Congress have cosponsored in the House or Senate.

Coalition Building

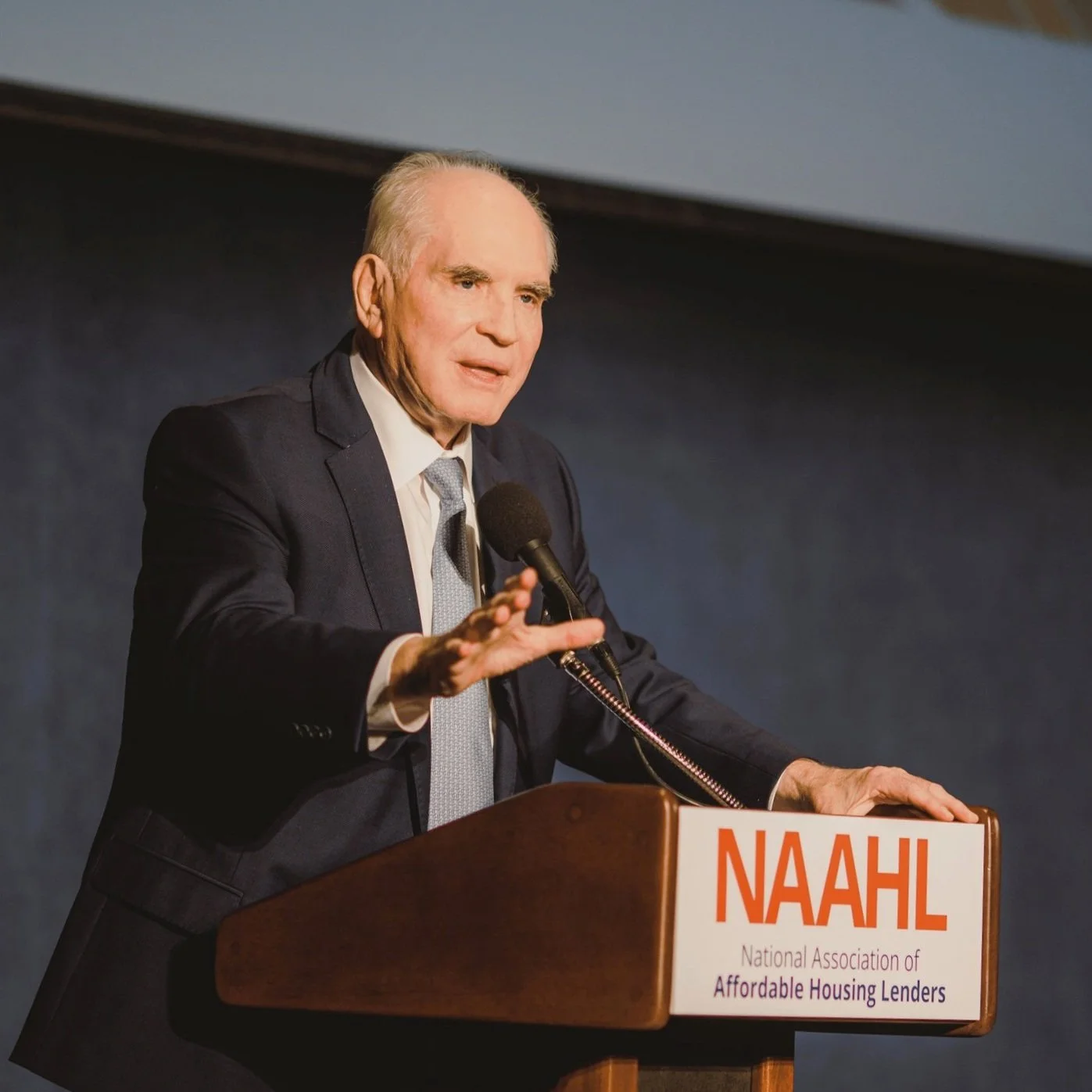

The Neighborhood Homes Coalition is a national advocacy group of 47 national organizations, including housing and community development nonprofits, financial institutions, and related trade associations – all supporting enactment of the Neighborhood Homes Investment Act. The coalition is co-chaired by the National Association of Affordable Housing Lenders (NAAHL), the National Community Stabilization Trust (NCST), and the Local Initiatives Support Corporation (LISC).

Interested in getting involved? Email neighborhoodhomes@naahl.org.

Congressional Champions

-

Senator Mark Warner

D-VA

“Everyone deserves a safe and affordable home, but across the Commonwealth, and across the country, too many neighborhoods are dealing with lack of investment, poor housing stock, and low home ownership rates. That’s why we need an all-hands-on-deck approach to investing in our communities. I’m excited to continue this important work with The Neighborhood Homes Investment Act — legislation that will encourage developers to build new and restored housing by providing a tax credit that will help them to invest in communities that need it the most.”

-

Senator Todd Young

R-IN

“Across Indiana, we have seen once-vibrant neighborhoods struggle under poor economic conditions and lack of investment. The Neighborhood Homes Investment Act would help restore these communities by directing private capital into neighborhoods in low-income census tracts, bridging the gap between the cost of renovation and neighborhood property values. This legislation also includes important guardrails to ensure that tax incentives target the families that need it most. I am encouraged by the increasing amount of support this effort is receiving, and I am hopeful that Congress will pass this legislation soon.”

-

Rep. John Larson

D-CT-1

“I am proud to join my colleague, Rep. Mike Kelly, to introduce a bipartisan solution to bring down costs and increase the supply of affordable housing. The Neighborhood Homes Investment Act will tackle our housing crisis by incentivizing the construction of new homes and the revitalization of vacant homes in need of repair. We will continue to work together to spur the development of good, quality housing in the Northeast and across the country, and make homeownership a reality for more of our nation’s families.”

-

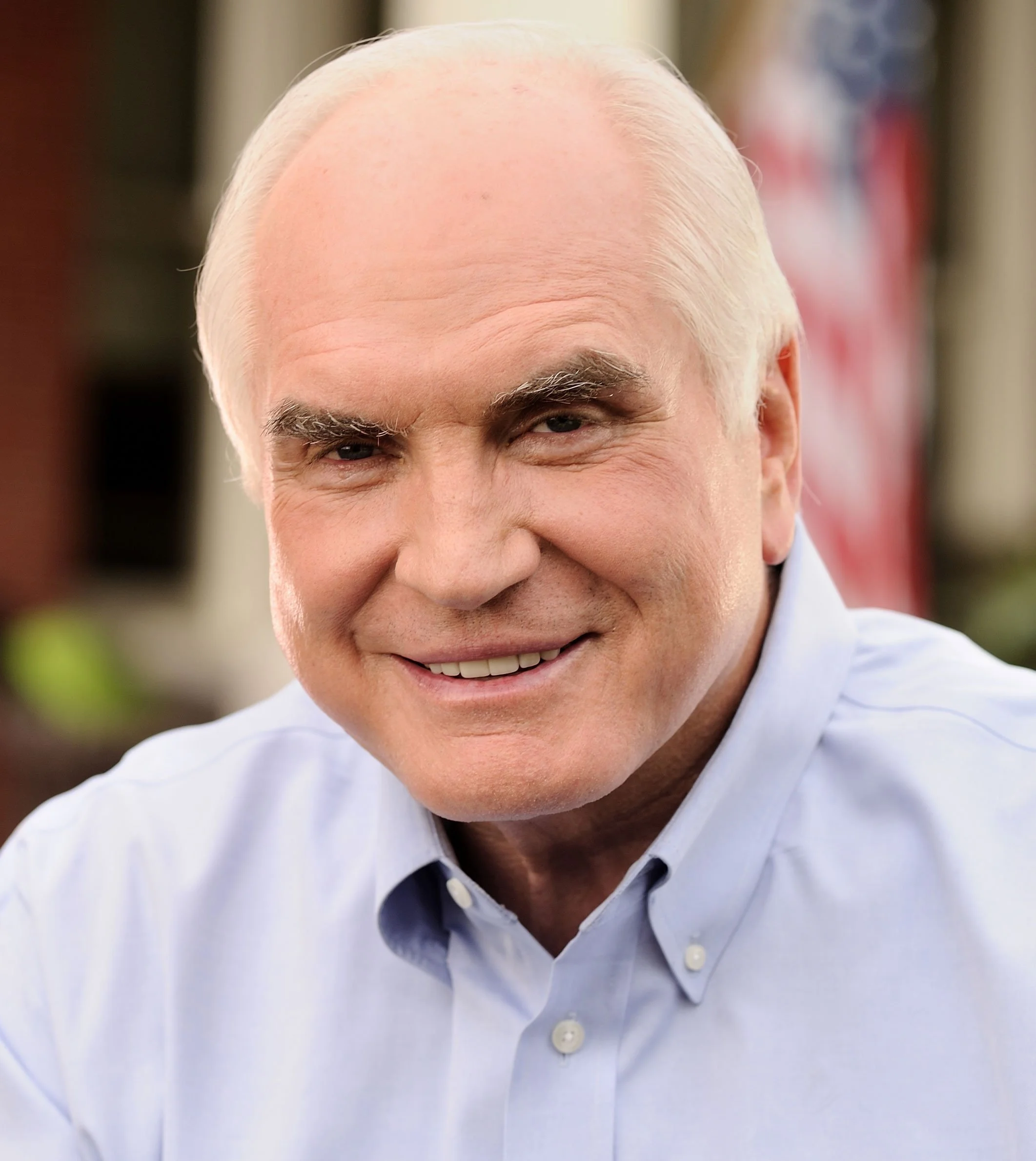

Rep. Mike Kelly

R-PA-16

“The Neighborhood Homes Investment Act will allow homeowners and developers to not only affordably restore beautiful homes, but also to build and create more affordable housing in communities that need it the most. For the families whose dreams of homeownership feel unattainable, this bill could make those dreams closer to reality. I am proud to join my colleagues in leading the bipartisan Neighborhood Homes Investment Act, which will create stronger homes, stronger families, and stronger neighborhoods.”

Advocacy Resources

Make use of these resources to advocate for Neighborhood Homes with your elected officials.

Coalition Members

The Neighborhood Homes Coalition is a national advocacy group of 48 national organizations, including housing and community development nonprofits, financial institutions, and related trade associations – all supporting enactment of the Neighborhood Homes Investment Act. The coalition is co-chaired by the National Association of Affordable Housing Lenders (NAAHL), the National Community Stabilization Trust (NCST), and the Local Initiatives Support Corporation (LISC).

Interested in getting involved? Email neighborhoodhomes@naahl.org.